January's Turo Insights in Atlanta, GA USA

Data covers listings 15 miles around Atlanta, GA USA

Let's talk data!

Welcome to TurboPricing.com, your go-to source for valuable insights into the Turo car-sharing marketplace.

In this blog post, we will dive into data specifically from Atlanta, GA, USA, covering key aspects that can help you optimize your Turo listings.

Here's what you can expect to learn:

Map of average prices of listings

5 most common car models

5 least common car models

Recent price and availability trends

Listings by the model year

Number of available listings by type of the models

Some cars never rented

Let's get started and uncover the insights that can help you maximize your Turo hosting experience!

Map of Average Prices of Listings

Understanding the average prices of Turo listings in various locations is crucial for optimizing your rental strategy.

By analyzing the price map, you can identify regions where demand is high and prices are competitive.

This insight allows you to adjust your pricing strategy accordingly, ensuring you remain attractive to potential renters while maximizing your earnings.

Consider factors such as local events, tourist seasons, and economic conditions that may influence pricing in your area.

Regularly reviewing this map will help you stay informed about market trends and make data-driven decisions.

5 most common car models

Understanding the most common car models on Turo can help you make informed decisions about your own listings. Here are the top five models currently dominating the platform, along with their availability and new bookings.

Toyota Corolla (2011 - 2025): 145 available listings, 203 new trips

Nissan Sentra (2013 - 2025): 133 available listings, 214 new trips

Nissan Altima (2012 - 2025): 120 available listings, 134 new trips

Kia Optima (2012 - 2020): 115 available listings, 193 new trips

Toyota Camry (2010 - 2024): 113 available listings, 126 new trips

These models not only have a high number of listings but also attract significant interest from renters, making them great options for potential Turo hosts.

5 Least Common Car Models

In the Turo marketplace, certain car models are notably rare, with very few listings available. Here are the five least common car models currently on the platform, along with their availability and new bookings.

McLaren 570S (2018) - 1 listing, 0 new bookings

Hyundai IONIQ 5 (2023) - 1 listing, 0 new bookings

Toyota RAV4 Hybrid (2017) - 1 listing, 1 new booking

Toyota Supra (2022) - 1 listing, 3 new bookings

Hyundai IONIQ 6 (2023) - 1 listing, 0 new bookings

These models may present unique opportunities for hosts looking to stand out in a competitive market.

Recent price and availability trends

In January 2025, Turo hosts experienced notable fluctuations in pricing and availability. The average daily rental price (mean) started at $79.60 and saw a gradual increase, peaking at $85.19 on January 3rd before declining to $70.67 by January 28th.

The median price (P50) also displayed variability, beginning at $59.75 and reaching $65.00 on January 3rd. However, it dropped to $51.00 by January 28th, indicating a potential shift in demand or competition among hosts.

The P90 price, which reflects the upper end of the market, remained relatively stable, fluctuating between $110.00 and $131.5. This suggests that while average prices dipped, there remained a segment of higher-end vehicles commanding premium rates.

Volume data indicates a robust market with a peak of 2,662 rentals on January 28th, suggesting strong demand despite the price fluctuations. Hosts should consider adjusting their pricing strategies to align with these trends, particularly focusing on the high-demand periods.

Overall, Turo hosts should remain vigilant about market dynamics, adjusting their listings to optimize earnings while catering to varying customer preferences.

Listings by the model year

Analyzing the available Turo listings by model year reveals interesting trends in the marketplace. The largest segment consists of older models, with 744 listings from 2015 and earlier. However, newer models are gaining traction, particularly those from 2023, which have 448 listings, and 2024, with 406 listings. The data shows a steady increase in listings from 2020 to 2021, peaking at 388 for 2021 before experiencing a slight decline in subsequent years. It's clear that hosts with newer models may have a competitive edge in attracting renters.

Number of Available Listings by Type of the Models

In the Turo marketplace, the distribution of available listings reveals a clear preference for certain vehicle types. Currently, there are 2,279 cars, making them the most abundant option. SUVs follow with 1,591 listings, showcasing their popularity among renters. Trucks and minivans are less common, with only 93 and 77 listings, respectively. This data highlights the importance of understanding vehicle type demand when optimizing your Turo listing.

Some Cars Never Rented

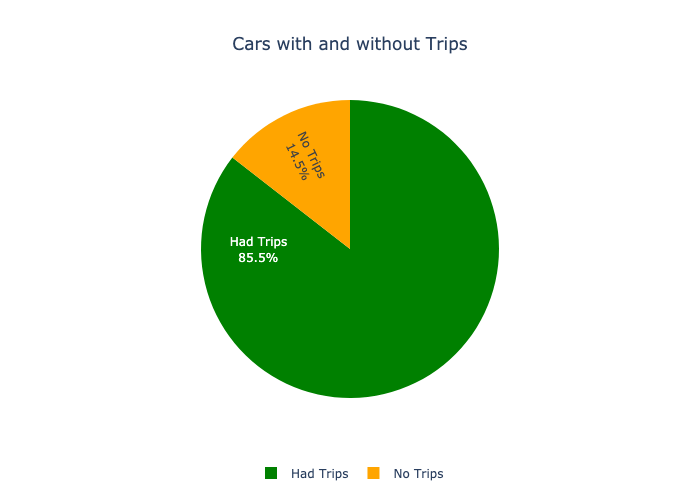

In analyzing the rental data, we observe a significant disparity in car utilization. Out of a total of 4,046 listings, 3,460 cars successfully completed trips, while 586 cars remained unrented. This indicates that nearly 14% of the cars listed on Turo have not generated any rental activity, highlighting potential areas for improvement in listing strategies.

Conclusion

In summary, optimizing your Turo listing is crucial for maximizing your earnings and staying competitive in the car rental market.

By understanding market trends, pricing strategies, and the importance of high-quality photos and descriptions, you can attract more renters and increase your bookings.

We encourage you to visit TurboPricing.com for more data and insights tailored to your city, helping you make informed decisions and elevate your Turo hosting experience.