January's Turo Insights in Boston, MA USA

Data covers listings 15 miles around Boston, MA USA

Let's talk data!

Welcome to TurboPricing.com, your go-to source for valuable insights into the Turo car-sharing marketplace.

In this blog post, we will dive into data specifically from Boston, MA, USA, covering several key sections.

Map of average prices of listings

5 most common car models

5 least common car models

Recent price and availability trends

Listings by the model year

Number of available listings by type of the models

Some cars never rented

Let's get started and uncover the trends that can help you optimize your Turo listings!

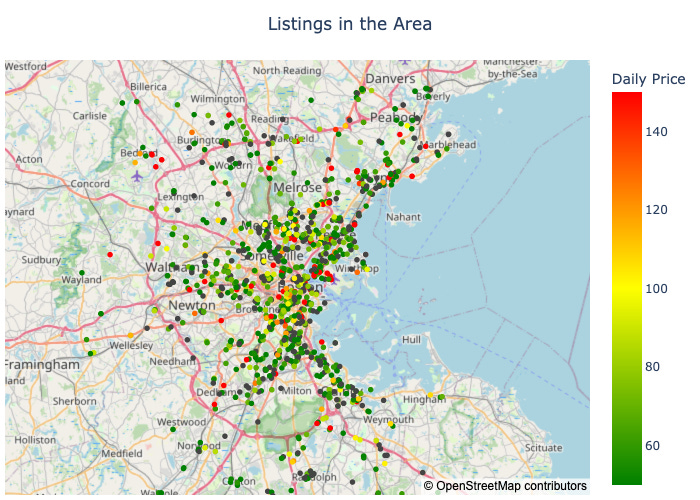

Map of Average Prices of Listings

Understanding the average prices of Turo listings in various regions is crucial for optimizing your rental strategy.

By analyzing the price map, you can identify competitive pricing in your area and adjust your rates accordingly.

This data can help you determine the best times to increase or decrease your prices based on demand.

Utilizing this information effectively can lead to higher visibility and increased bookings.

Stay informed about regional trends to maximize your earnings and attract more renters.

5 most common car models

Understanding the most common car models on Turo can help hosts make informed decisions about their listings. Here are the top five models currently available, along with their listing counts and new bookings.

Tesla Model Y (2020 - 2025): 72 listings, 30 new bookings

Toyota Corolla (2013 - 2025): 71 listings, 78 new bookings

Tesla Model 3 (2018 - 2025): 66 listings, 44 new bookings

Hyundai Elantra (2012 - 2024): 43 listings, 43 new bookings

Honda CR-V (2013 - 2025): 39 listings, 24 new bookings

These models reflect current market preferences, and aligning your offerings with these trends can enhance your rental success.

5 Least Common Car Models

In the Turo marketplace, certain car models are significantly less common than others. Here are the five least common models currently available, each with only one listing and no new bookings recorded.

Acura Integra (2023) - 1 listing, 0 new bookings

Hyundai Tucson Plug-In Hybrid (2023) - 1 listing, 0 new bookings

Hyundai Veloster (2012) - 1 listing, 0 new bookings

INFINITI QX50 (2019) - 1 listing, 0 new bookings

INFINITI QX55 (2022) - 1 listing, 0 new bookings

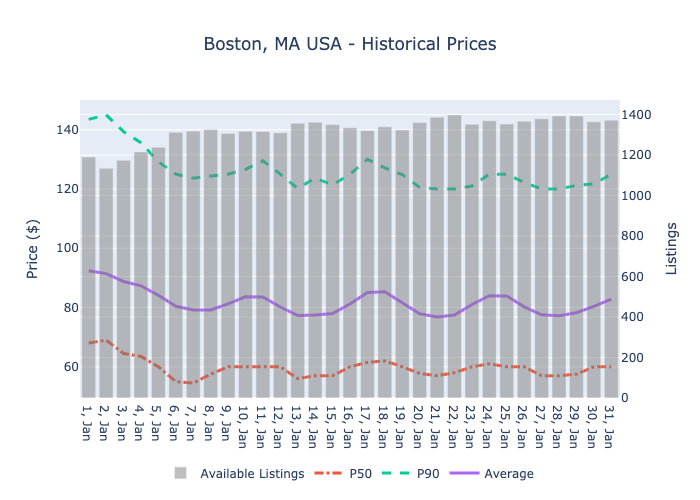

Recent price and availability trends

In January 2025, Turo hosts experienced notable fluctuations in pricing and availability. The median price (P50) started at $68.00 and gradually decreased to $60.00 by the end of the month, while the mean price hovered around $92.39 initially, dropping to $82.81. The P90 price, which reflects the higher-end listings, also saw a decline from $143.50 to $125.00.

The volume of rentals varied throughout the month, starting at 1,190 and peaking at 1,398 on January 22. Despite the decrease in prices, the volume remained relatively stable, indicating a consistent demand for rentals. This suggests that while hosts may need to adjust their pricing strategies, the overall interest in Turo rentals remains strong.

The data indicates a trend towards lower pricing as the month progressed, which could be attributed to seasonal factors or increased competition among hosts. Hosts should consider this trend when setting their prices, ensuring they remain competitive while maximizing their earnings.

In summary, January 2025 showcased a dynamic rental market for Turo hosts. By closely monitoring these trends, hosts can make informed decisions about pricing and availability to optimize their listings.

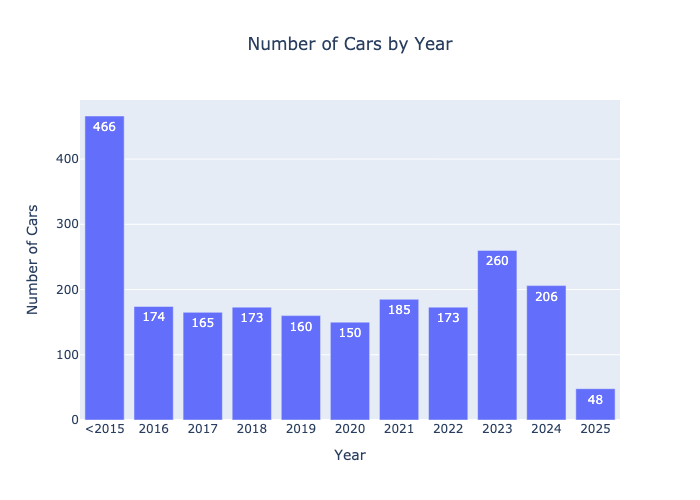

Listings by the model year

Analyzing the available listings by model year reveals interesting trends in the Turo marketplace. The oldest models, those from 2015 or earlier, dominate the listings with 466 vehicles. However, newer models are gaining traction, particularly the 2023 and 2024 models, which have 260 and 206 listings, respectively. Notably, the 2021 model year shows a strong presence with 185 listings, while the 2025 models are just starting to emerge with 48 listings. This data indicates a growing interest in newer vehicles, suggesting hosts may benefit from updating their fleets to attract more renters.

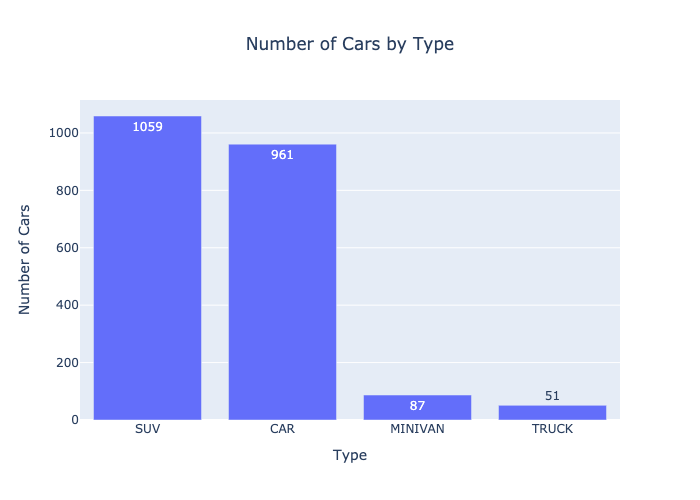

Number of Available Listings by Type of Models

In the Turo marketplace, the distribution of available listings by vehicle type reveals interesting trends. SUVs lead the pack with 1,059 listings, making them the most popular choice among hosts. Following closely are standard cars with 961 listings. Minivans and trucks have significantly fewer options, with only 87 and 51 listings, respectively. This data highlights the strong demand for SUVs and cars, suggesting that hosts may benefit from focusing on these categories to maximize their rental opportunities.

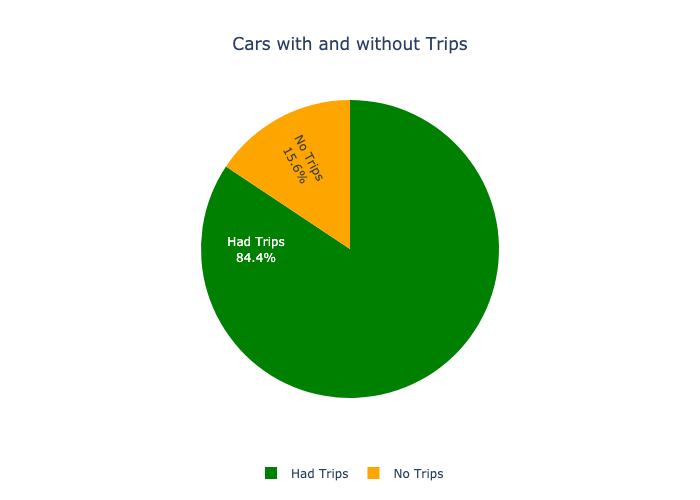

Some Cars Never Rented

The data reveals a significant disparity in rental activity among Turo listings. Out of a total of 2,160 cars, 1,822 have successfully completed trips, indicating a strong demand for certain vehicles. However, 338 cars remain unrented, highlighting that not all listings attract interest. This suggests that factors such as car type, pricing, and location play crucial roles in a vehicle's rental success.

Conclusion

In conclusion, optimizing your Turo listing requires a keen understanding of market trends, competitive pricing, and effective marketing strategies.

By focusing on high-demand car models, maintaining excellent customer service, and utilizing data-driven insights, you can significantly enhance your rental income.

We encourage you to visit TurboPricing.com for more tailored data and insights specific to your city, helping you stay ahead in the Turo marketplace.