January's Turo Insights in Chicago, IL USA

Data covers listings 15 miles around Chicago, IL USA

Let's talk data!

Welcome to TurboPricing.com, your go-to resource for valuable insights into the Turo car-sharing marketplace.

In this blog post, we will delve into data specifically from Chicago, IL, USA. Here's what you can expect to learn:

Map of average prices of listings

5 most common car models

5 least common car models

Recent price and availability trends

Listings by the model year

Number of available listings by type of the models

Some cars never rented

Let's get started and uncover the insights that can help you optimize your Turo listings!

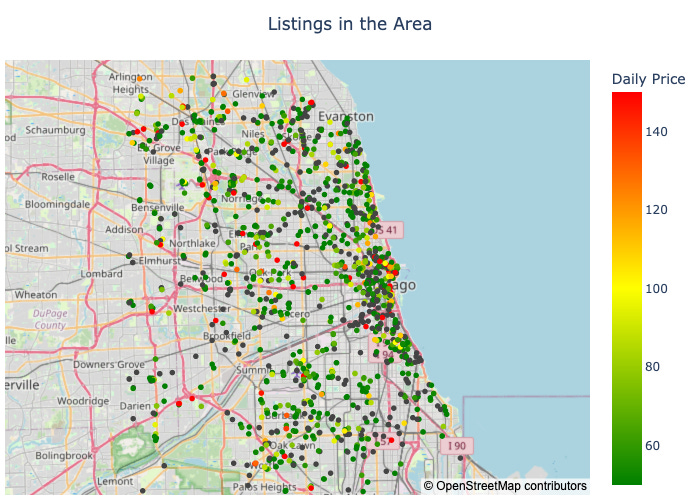

Map of Average Prices of Listings

Understanding the average prices of Turo listings in your area is crucial for optimizing your rental strategy. By analyzing price trends, you can set competitive rates that attract more renters while maximizing your earnings.

Utilizing a map of average prices can help you visualize how your listing compares to others in your region. This insight allows you to adjust your pricing based on local demand and competition.

Consider these key factors when reviewing the map:

Identify high-demand areas where prices are elevated.

Spot regions with lower average prices to adjust your strategy accordingly.

Monitor seasonal trends that may affect pricing in different locations.

By leveraging this data, you can make informed decisions that enhance your listing's visibility and profitability.

5 most common car models

Understanding the most common car models on Turo can help hosts make informed decisions about their listings. Here are the top five models currently dominating the platform, along with their availability and new bookings.

Toyota Corolla (2009 - 2025): 104 available listings, 123 new bookings

Tesla Model 3 (2017 - 2025): 85 available listings, 81 new bookings

Nissan Sentra (2013 - 2025): 72 available listings, 139 new bookings

Tesla Model Y (2020 - 2025): 65 available listings, 60 new bookings

Honda Civic (2008 - 2025): 64 available listings, 92 new bookings

5 Least Common Car Models

In the Turo marketplace, certain car models are significantly less common than others. This can present unique opportunities for hosts looking to stand out in a competitive environment. Here are the five least common car models currently listed:

Nissan Rogue Select (2014) - 1 available listing, 0 new bookings

FIAT 500X (2016) - 1 available listing, 0 new bookings

FIAT 500c (2012) - 1 available listing, 0 new bookings

McLaren GT (2021) - 1 available listing, 1 new booking

McLaren 570GT (2017) - 1 available listing, 3 new bookings

These models may not attract high volumes of bookings, but they can appeal to niche markets and car enthusiasts.

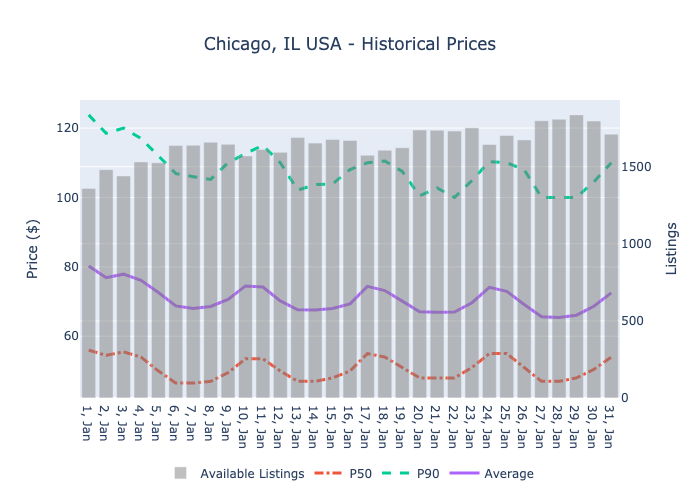

Recent price and availability trends

In January 2025, Turo hosts experienced notable fluctuations in rental prices and availability. The median price (P50) ranged from a low of $46.5 to a high of $56, while the 90th percentile price (P90) peaked at $123.8. The average rental price for the month was approximately $80.24, indicating a healthy demand despite some price dips.

The volume of rentals also showed an upward trend, with a peak of 1,839 rentals on January 28. This suggests that hosts were actively engaging with the market, likely responding to seasonal demand. Notably, the average price decreased over the month, indicating a potential increase in competition among hosts, which could lead to lower prices to attract renters.

Hosts should consider these trends when setting their pricing strategies. Monitoring the P50 and P90 values can help in positioning their listings competitively. Additionally, understanding the volume trends can guide hosts in optimizing their availability during peak rental periods.

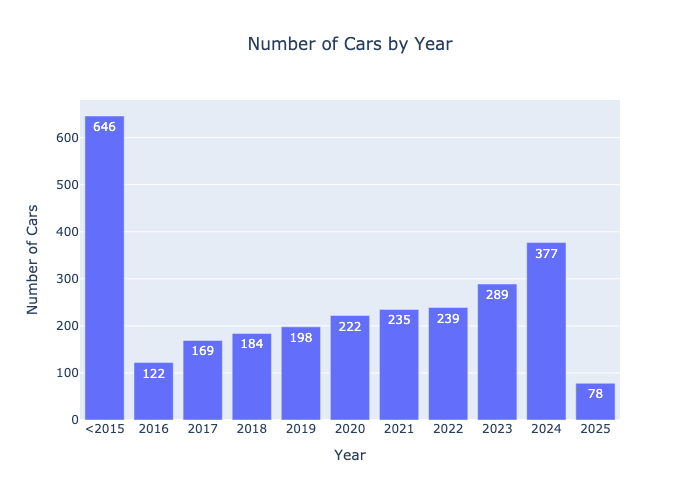

Listings by the model year

Analyzing the data on Turo listings by model year reveals a clear trend towards newer vehicles. Listings for cars made in 2015 or older total 646, significantly overshadowed by the increasing availability of newer models. The year 2024 shows the highest count with 377 listings, while 2023 follows closely with 289. Interestingly, the 2025 models, despite being the newest, have only 78 listings, indicating a potential lag in availability. This trend suggests that hosts should consider investing in newer models to attract more renters.

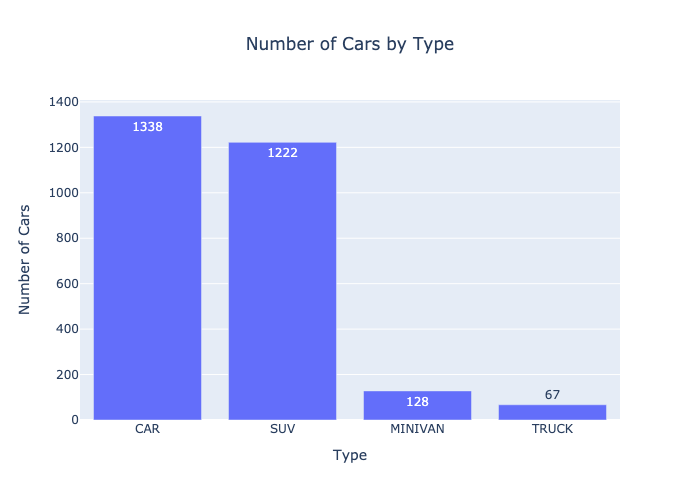

Number of Available Listings by Type of the Models

In the current Turo marketplace, the distribution of available listings by vehicle type reveals interesting trends. The most common listing is the standard car, with a total of 1,338 available options. Following closely are SUVs, which account for 1,222 listings. Minivans and trucks are less prevalent, with 128 and 67 listings, respectively. This data highlights the popularity of cars and SUVs among hosts, suggesting a strong demand for these vehicle types.

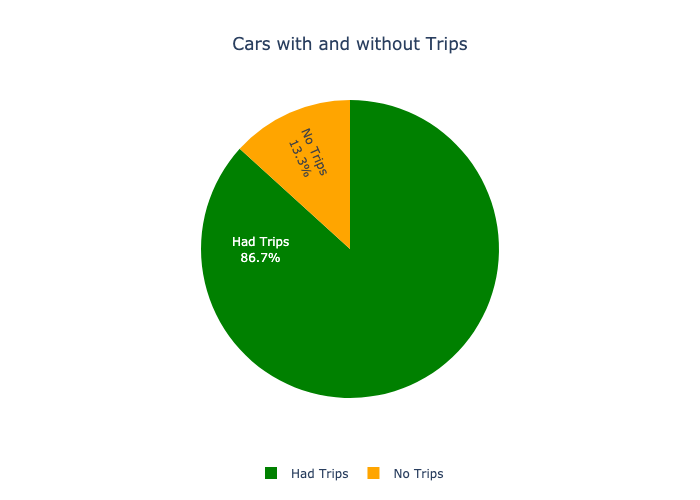

Some Cars Never Rented

In analyzing the rental data, we find that out of a total of 2,759 cars listed, 2,393 have successfully completed trips, while 366 cars have not been rented at all. This indicates that a significant portion of listings remains inactive, highlighting the importance of optimizing your car's appeal and visibility to attract potential renters.

Conclusion

In summary, optimizing your Turo listing is essential for maximizing your earnings and attracting more renters. Key strategies include understanding market trends, pricing competitively, and enhancing your vehicle's appeal through quality photos and detailed descriptions.

By staying informed about the latest data and insights, you can make informed decisions that will set you apart from other hosts.

For more tailored data and insights specific to your city, we invite you to visit TurboPricing.com. Together, we can help you elevate your Turo hosting experience.