January's Turo Insights in Miami, FL USA

Data covers listings 15 miles around Miami, FL USA

Let's talk data!

Welcome to TurboPricing.com, your go-to source for valuable insights into the Turo car-sharing marketplace.

In this blog post, we will delve into data from Miami, FL, USA, covering several key sections that will help you optimize your Turo listings.

Map of average prices of listings

5 most common car models

5 least common car models

Recent price and availability trends

Listings by the model year

Number of available listings by type of the models

Some cars never rented

Stay tuned as we explore these insights to help you maximize your earnings on Turo!

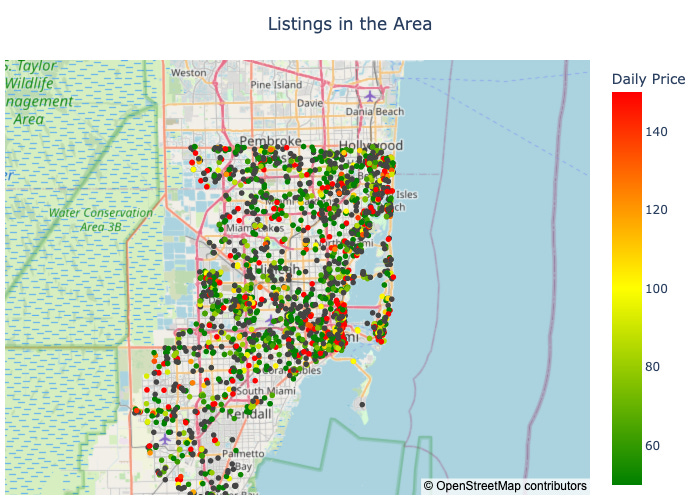

Map of Average Prices of Listings

Understanding the average prices of Turo listings in different regions is crucial for hosts looking to optimize their pricing strategy.

By analyzing a map of average prices, hosts can identify competitive pricing in their area and adjust their rates accordingly.

This insight not only helps in attracting more renters but also ensures that hosts maximize their earnings.

Consider factors such as location, vehicle type, and seasonal demand when setting your prices.

Utilizing tools and resources that provide visual representations of pricing trends can greatly enhance your decision-making process.

Stay informed about market fluctuations to remain competitive and profitable in the Turo marketplace.

5 most common car models

Understanding the most popular car models on Turo can help hosts optimize their listings and attract more bookings. Here are the five most common car models currently available, along with their number of listings and total new bookings.

Tesla Model 3 (2018 - 2025): 246 listings, 472 new bookings

Toyota Corolla (2013 - 2025): 168 listings, 235 new bookings

Ford Mustang (2013 - 2024): 167 listings, 358 new bookings

Chevrolet Corvette (1975 - 2025): 164 listings, 258 new bookings

Tesla Model Y (2020 - 2025): 147 listings, 224 new bookings

By focusing on these popular models, Turo hosts can enhance their chances of securing more rentals and increasing their earnings.

5 Least Common Car Models

In the Turo marketplace, certain car models are significantly less common than others. Here are the five least common car models currently listed, along with their availability and new bookings.

smart fortwo (2016) - 1 listing, 3 new bookings

Chevrolet Impala (2019) - 1 listing, 0 new bookings

Jeep Grand Cherokee 4xe (2022) - 1 listing, 0 new bookings

Chevrolet Cruze Limited (2016) - 1 listing, 0 new bookings

Kia Cadenza (2018) - 1 listing, 2 new bookings

These models may present unique opportunities for hosts looking to differentiate their offerings in a competitive market.

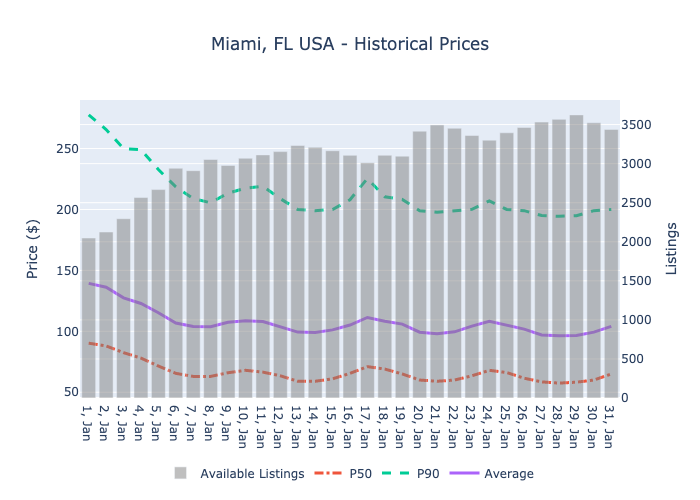

Recent price and availability trends

In January 2025, Turo hosts experienced notable fluctuations in pricing and availability. The median price (P50) started at $90.25 and gradually decreased to $65.00 by the end of the month. Meanwhile, the mean price saw a decline from $139.34 to $104.06, indicating a shift in market dynamics.

The data reveals a consistent increase in rental volume, peaking at 3,624 rentals on January 29. Despite the drop in prices, the growing volume suggests a rising demand for rentals, likely driven by competitive pricing strategies among hosts.

The P90 prices, which represent the higher end of the market, also showed a downward trend, starting at $277.60 and ending at $200.00. This indicates that even premium listings are adjusting to the competitive landscape. Hosts should consider these trends when setting their prices to attract more renters while maximizing their earnings.

Overall, Turo hosts should remain vigilant about pricing strategies and market trends. Adapting to these changes can enhance visibility and rental frequency, ultimately leading to increased profitability.

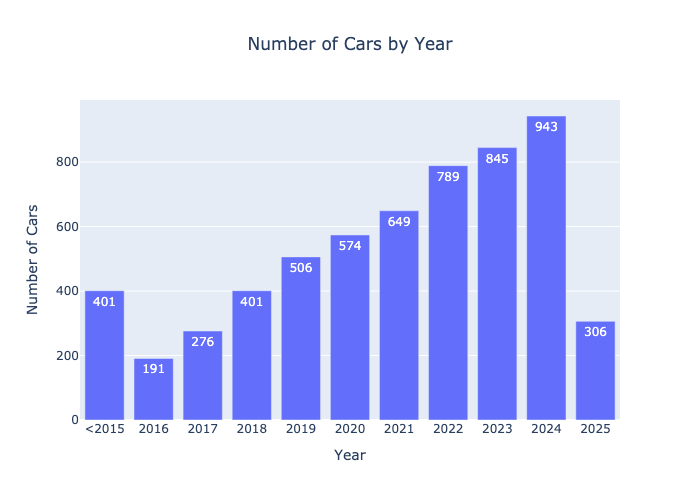

Listings by the model year

Analyzing the available Turo listings by model year reveals a clear trend towards newer vehicles. The data shows that listings for models from 2015 or older total 401, while the number of listings steadily increases for newer models. Notably, the year 2024 has the highest count at 943 listings, indicating a growing preference for the latest vehicles. The peak in 2023 with 845 listings further emphasizes this trend, suggesting that hosts should consider investing in newer models to attract more renters.

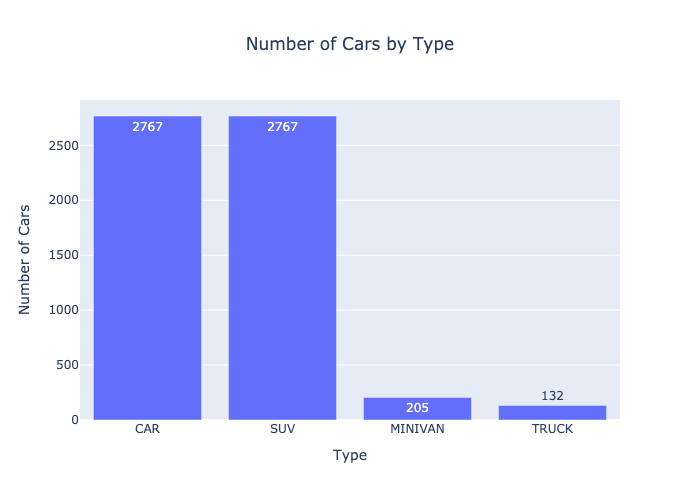

Number of Available Listings by Type of the Models

In the Turo marketplace, the distribution of available listings by vehicle type reveals interesting trends. Currently, there are 2,767 cars and 2,767 SUVs listed, indicating a strong demand for both categories. Additionally, minivans account for 205 listings, while trucks are represented by 132 listings. This data highlights the popularity of traditional cars and SUVs, suggesting that hosts should consider these types for maximizing their rental potential.

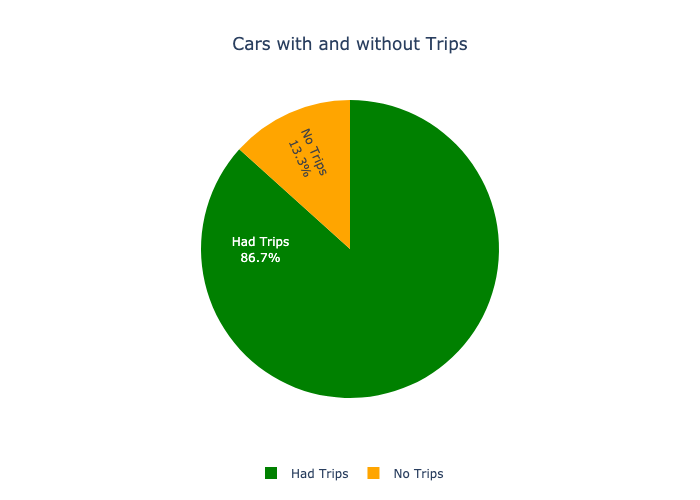

Some Cars Never Rented

In analyzing the rental data, we find that out of 5,881 total cars, 784 have never been rented, indicating that a significant portion of listings may not be attracting interest. This suggests that hosts should evaluate their listings to understand why certain vehicles remain idle and consider adjustments to pricing, marketing, or availability to enhance their rental potential.

Conclusion

In summary, optimizing your Turo listing involves understanding market trends, pricing strategies, and the importance of customer service.

By implementing the insights shared in this blog post, you can enhance your visibility, attract more renters, and ultimately maximize your earnings.

For more data and tailored insights specific to your city, we invite you to visit TurboPricing.com. Stay ahead in the competitive Turo marketplace!