January's Turo Insights in Philadelphia, PA USA

Data covers listings 15 miles around Philadelphia, PA USA

Let's talk data!

Welcome to TurboPricing.com, your go-to resource for insights into the Turo car-sharing marketplace.

In this blog post, we will dive into valuable data from Philadelphia, PA, covering key aspects of the local Turo market.

Map of average prices of listings

5 most common car models

5 least common car models

Recent price and availability trends

Listings by the model year

Number of available listings by type of the models

Some cars never rented

Stay tuned as we explore these insights to help you optimize your Turo listings and maximize your earnings!

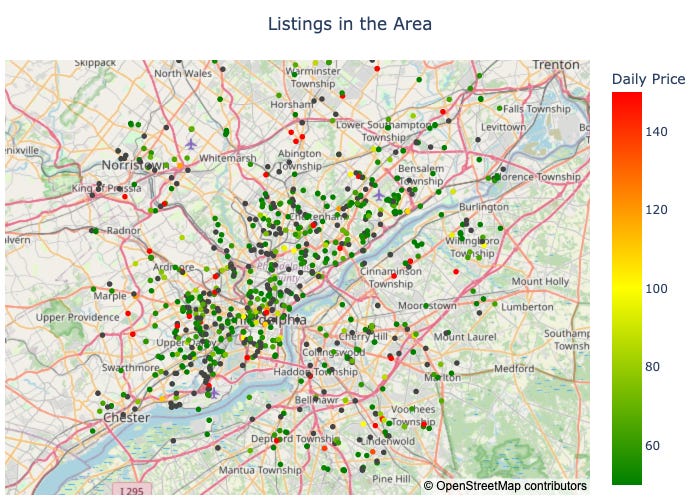

Map of Average Prices of Listings

Understanding the average prices of Turo listings across different regions is crucial for hosts looking to optimize their pricing strategies.

A well-structured map can provide insights into how prices vary by location, helping you identify competitive pricing in your area.

For example, urban areas often have higher demand and, consequently, higher average prices compared to rural locations.

By analyzing this data, hosts can adjust their pricing to attract more renters while maximizing earnings.

Additionally, consider seasonal trends that may affect pricing, such as holidays or local events, to further refine your strategy.

Utilizing tools that visualize this data can make it easier to spot trends and make informed decisions.

In conclusion, leveraging a map of average prices can significantly enhance your ability to price competitively and increase your rental income.

5 most common car models

Understanding which car models are most popular among Turo hosts can help you make informed decisions about your own listings. Here are the five most common car models currently available on the platform, along with their respective number of listings and new bookings.

Chevrolet Malibu (2012 - 2024): 61 listings, 140 new bookings

Hyundai Elantra (2011 - 2025): 58 listings, 126 new bookings

Nissan Altima (2013 - 2025): 56 listings, 83 new bookings

Tesla Model 3 (2018 - 2025): 50 listings, 82 new bookings

Toyota Corolla (2011 - 2024): 47 listings, 89 new bookings

5 Least Common Car Models

In the Turo marketplace, certain car models are notably rare. Here are the five least common models currently available, along with their listing counts and new bookings.

Jaguar XF (2015) - 1 listing, 0 new bookings

Dodge Hornet (2024) - 1 listing, 1 new booking

Land Rover Discovery Sport (2015) - 1 listing, 0 new bookings

Land Rover Range Rover Evoque (2020) - 1 listing, 7 new bookings

Lexus NX (2018) - 1 listing, 0 new bookings

These models may present unique opportunities for hosts looking to attract niche customers.

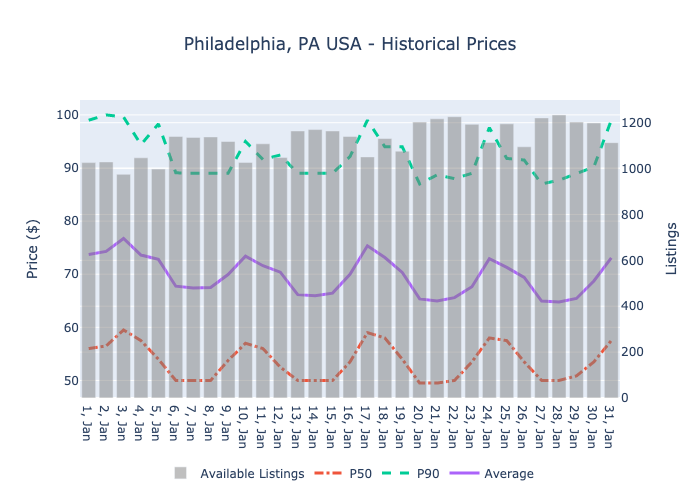

Recent price and availability trends

In January 2025, Turo hosts experienced notable fluctuations in pricing and availability. The median price (P50) ranged from a low of $49.5 to a high of $59.5, while the 90th percentile price (P90) peaked at $100. This indicates a competitive market with varying demand.

The average price (mean) across the month was approximately $70.81, with a total of 1026 listings on the first day and a gradual increase in volume, peaking at 1226 listings by January 22. This trend suggests that hosts are responding to market demand by adjusting their availability.

Notably, the highest volume of listings coincided with lower average prices, indicating a possible oversupply in the market. As hosts, it's crucial to monitor these trends closely to optimize pricing strategies and ensure competitive positioning.

In summary, January's data reflects a dynamic market where pricing strategies should be flexible. Hosts should consider adjusting their rates based on daily trends and overall demand to maximize earnings.

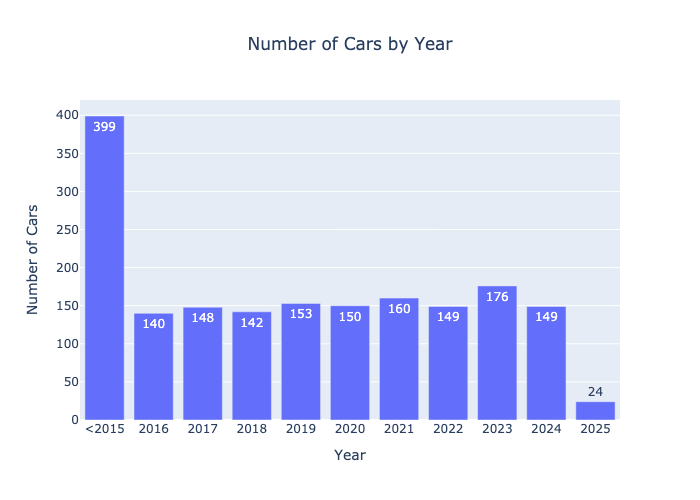

Listings by the model year

Analyzing the available Turo listings by model year reveals interesting trends in vehicle availability. The largest group consists of older models (2015 or older), with 399 listings. In contrast, newer models show a gradual increase in availability, peaking in 2023 with 176 listings. The years 2021 and 2020 also demonstrate strong numbers, with 160 and 150 listings, respectively. However, the count drops significantly for 2025, indicating a potential lag in new listings for the upcoming model year. This data suggests hosts should consider the demand for newer vehicles while also recognizing the substantial market for older models.

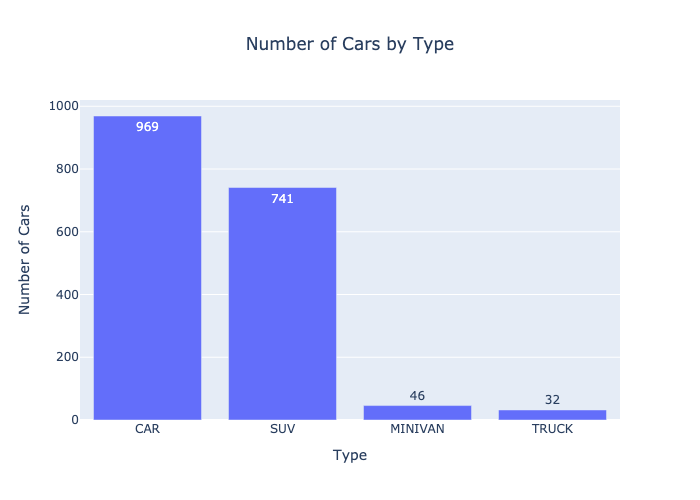

Number of Available Listings by Type of Models

In the Turo marketplace, the distribution of available listings by vehicle type reveals interesting trends. Currently, there are 969 cars, making them the most abundant category. SUVs follow with 741 listings, indicating a strong demand for larger vehicles. Minivans and trucks are less common, with only 46 and 32 listings respectively. This data highlights the popularity of standard cars and SUVs, suggesting that hosts may benefit from focusing on these types to maximize their rental potential.

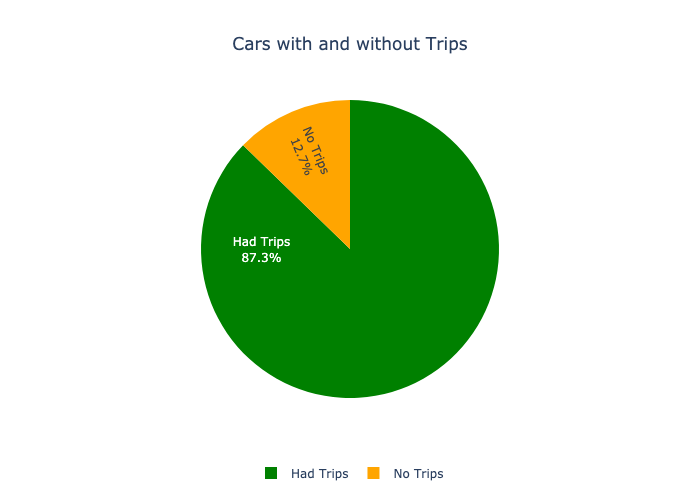

Some Cars Never Rented

The data reveals a significant disparity in rental activity among Turo listings. Out of a total of 1,790 cars, 1,562 have successfully completed trips, showcasing a strong demand for certain vehicles. However, 228 cars have not been rented at all, indicating that some listings may require optimization or reevaluation to attract potential renters.

Conclusion

In summary, optimizing your Turo listing involves understanding market trends, pricing strategies, and the importance of vehicle presentation.

By leveraging data and insights, you can enhance your rental performance and maximize your earnings.

For more tailored data and insights specific to your city, we invite you to visit TurboPricing.com.